Exploring the rich intertextual links between the Old and New Testaments, a compilation of quotes—often found as a PDF list—reveals profound theological connections.

Pinterest showcases resources detailing these shared verses, highlighting the New Testament’s reliance on, and fulfillment of, Old Testament prophecies and themes.

The Significance of Intertextuality

Intertextuality, the relationship between texts, is paramount when examining the New Testament’s use of the Old. A PDF compilation of Old Testament quotes within the New Testament isn’t merely an academic exercise; it unveils a deliberate literary strategy. The New Testament authors didn’t operate in a vacuum, but rather built upon a pre-existing scriptural foundation.

Pinterest results demonstrate a popular interest in identifying these connections. Recognizing these quotes illuminates how the New Testament authors presented Jesus as the fulfillment of ancient prophecies. This practice wasn’t accidental; it was a persuasive technique, appealing to a Jewish audience familiar with the Old Testament;

Understanding this intertextual dialogue is crucial for grasping the New Testament’s theological claims and appreciating the continuity of God’s redemptive plan throughout history. It reveals a cohesive narrative, rather than a disjointed collection of stories.

Purpose of a PDF Compilation

A PDF compilation of Old Testament quotations found in the New Testament serves several vital purposes. Primarily, it provides a readily accessible resource for students, pastors, and anyone seeking to deepen their understanding of biblical connections. Such a list facilitates comparative study, allowing readers to trace themes and prophecies across both testaments.

Resources, like those highlighted on Pinterest, demonstrate the demand for organized lists of these verses. A well-structured PDF can reveal patterns often missed in casual reading, showcasing how the New Testament authors interpreted and applied Old Testament passages.

Furthermore, it aids in theological reflection, supporting arguments for the unity of Scripture and the messianic identity of Jesus. It’s a practical tool for sermon preparation, Bible study, and personal devotion, fostering a richer appreciation for the biblical narrative.

Historical Context of Quotations

Understanding the historical context of Old Testament quotations in the New Testament is crucial. The New Testament wasn’t written in a vacuum; its authors addressed a first-century Jewish audience intimately familiar with the Hebrew Scriptures. They often quoted from the Septuagint (LXX), the Greek translation of the Old Testament, prevalent at the time.

A PDF compilation aids in recognizing these nuances. The way a verse was understood in the intertestamental period, or how it resonated with contemporary Jewish expectations, informs its meaning in the New Testament. Pinterest resources, while providing lists, benefit from contextual study.

Moreover, recognizing the literary techniques—direct quotes, allusions, paraphrases—employed by New Testament authors reveals their interpretive strategies and their intent to demonstrate Jesus as the fulfillment of prophecy.

Common Old Testament Quotations in the New Testament

Numerous Old Testament verses appear throughout the New Testament, often compiled in PDF lists for study. Pinterest highlights examples, revealing a deep intertextual connection.

Quotation of Genesis

Genesis provides foundational quotations woven into the New Testament narrative. A PDF compilation reveals key connections, such as Genesis 1:27 and Matthew 19:4-6, both addressing creation and the sanctity of marriage, demonstrating a consistent divine perspective.

Furthermore, Genesis 3:15, the prophecy concerning the “seed of the woman” and the serpent, finds striking resonance in Revelation 12:17. Resources like those found on Pinterest illustrate how the New Testament authors understood Jesus as the fulfillment of this ancient promise, battling the forces of evil. These examples, readily available in quote lists, underscore the theological continuity between the testaments.

Studying these parallels enhances understanding of both the historical context and the overarching biblical story.

Genesis 1:27 & Matthew 19:4-6 (Creation & Marriage)

Genesis 1:27, detailing God’s creation of male and female, directly informs Matthew 19:4-6, where Jesus affirms the original divine design for marriage—one man and one woman. A PDF list of Old Testament quotes in the New Testament highlights this crucial link, demonstrating Jesus’ adherence to foundational biblical principles.

This connection isn’t merely coincidental; it’s a deliberate appeal to the authority of Genesis. Resources available online, often summarized in downloadable guides, showcase how Jesus uses this creation account to refute attempts to redefine marriage. The consistency between these passages reinforces the biblical view of marriage as a sacred, divinely ordained institution.

Understanding this intertextual relationship deepens appreciation for the Bible’s cohesive narrative.

Genesis 3:15 & Revelation 12:17 (The Seed of the Woman & the Serpent)

Genesis 3:15, the protoevangelium—the first gospel promise—foretells a conflict between the “seed of the woman” and the serpent. This prophecy finds remarkable fulfillment in Revelation 12:17, which describes the ongoing battle between the followers of Christ and Satan. A PDF compilation of Old Testament quotations reveals this powerful connection.

Many study guides detail how the “seed of the woman” ultimately refers to Jesus Christ, who crushes the serpent’s head through his death and resurrection. Online resources emphasize that Revelation doesn’t introduce a new concept, but rather unveils the long-awaited fulfillment of God’s ancient promise.

This intertextual link underscores the overarching narrative of redemption woven throughout Scripture.

Quotation of Exodus

Exodus, detailing Israel’s liberation, provides significant material quoted in the New Testament. A comprehensive PDF list of these quotations highlights the thematic connections between the two testaments. The New Testament authors frequently draw upon Exodus to illustrate Jesus’ identity and mission.

These connections aren’t merely coincidental; they demonstrate a deliberate theological intent. Resources available online showcase how the Exodus narrative serves as a typological foreshadowing of Christ’s redemptive work.

Examining these quotations within a PDF study guide reveals how Jesus fulfills the patterns and promises established in the Old Testament, offering a new and greater exodus from sin and death.

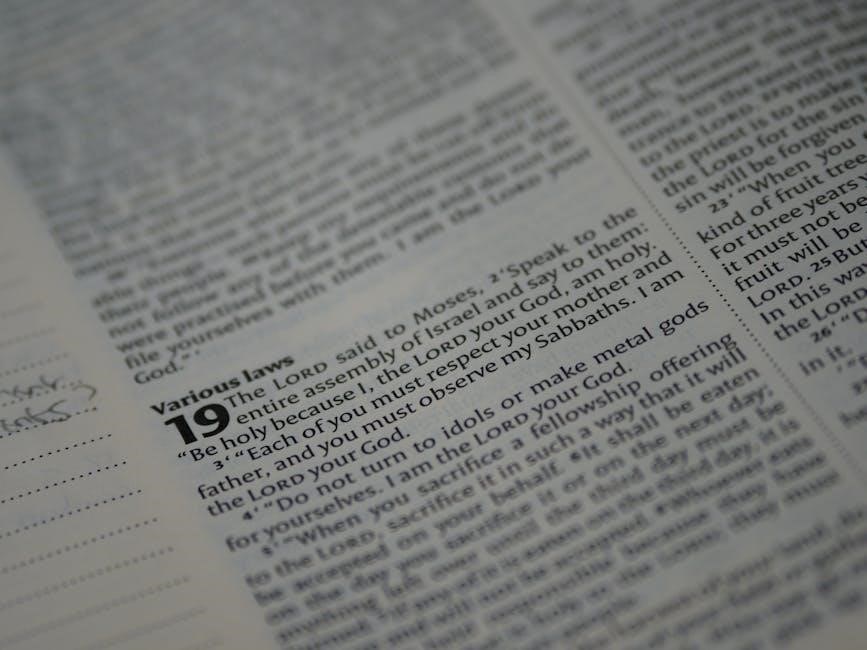

Exodus 20:16 & Ephesians 6:2-3 (Honor Your Father & Mother)

Exodus 20:16, the fifth commandment – “Honor your father and your mother” – finds direct echo in Ephesians 6:2-3. A detailed PDF compilation of Old Testament quotations in the New Testament clearly demonstrates this continuity. Paul, in his letter to the Ephesians, reiterates this commandment, framing it within the context of Christian living and familial responsibility.

This isn’t simply a repetition, but a reaffirmation of a foundational moral principle. Resources online, often presented as downloadable PDF study guides, emphasize the importance of honoring parents as a pathway to a blessed life, reflecting God’s own character.

The inclusion of this commandment highlights the enduring relevance of Old Testament ethics within the New Covenant.

Exodus 3:14 & John 8:58 (I AM)

Exodus 3:14 reveals God’s self-declaration to Moses – “I AM WHO I AM” – a profound statement of divine existence. This powerful phrase resonates strikingly in John 8:58, where Jesus declares, “Before Abraham was, I AM.” A comprehensive PDF list of Old Testament quotes in the New Testament illuminates this crucial connection.

Jesus’ use of “I AM” isn’t merely a statement of being, but a deliberate claim to deity, echoing the divine name revealed to Moses. PDF study guides often highlight this as a pivotal moment, demonstrating Jesus’ self-identification with Yahweh.

This intertextual link, readily available in online resources, underscores Jesus’ divine nature and authority.

Quotation of Psalms

The Book of Psalms is extensively quoted within the New Testament, forming a cornerstone of early Christian theology. A detailed PDF compilation of Old Testament quotations reveals numerous instances where New Testament authors draw upon the Psalms to illuminate Jesus’ identity and mission. Resources, like those found through online searches, demonstrate this pervasive influence.

These aren’t simply isolated verses; they represent a deliberate weaving of Old Testament prophecy into the narrative of the New Testament. PDF study guides often categorize these quotations, highlighting their significance in understanding Messianic fulfillment.

Exploring these connections provides a richer understanding of the continuity between the Testaments, readily accessible through curated lists.

Psalm 2:7 & Hebrews 1:5 (Son of God)

Psalm 2:7, “You are my Son, today I have begotten you,” finds striking fulfillment in Hebrews 1:5, where it’s directly applied to Jesus Christ. A comprehensive PDF list of Old Testament quotations in the New Testament meticulously details this connection, showcasing how early Christians interpreted this Psalm as Messianic prophecy.

Hebrews explicitly links this verse to the divine sonship of Jesus, establishing His unique relationship with God the Father. PDF study resources often analyze the implications of this declaration, emphasizing Jesus’ pre-existence and divine nature.

This quotation, readily found in compiled lists, demonstrates the New Testament’s intentional use of the Old Testament to validate Jesus’ identity.

Psalm 22:1 & Matthew 27:46 (My God, My God, Why Have You Forsaken Me?)

Psalm 22:1, a poignant cry of abandonment, “My God, my God, why have you forsaken me?” is powerfully echoed in Matthew 27:46 during Jesus’ crucifixion. A detailed PDF compilation of Old Testament quotes in the New Testament highlights this as a deliberate fulfillment of prophecy.

Jesus’ utterance on the cross isn’t merely a statement of despair, but a conscious identification with the suffering servant depicted in Psalm 22. PDF study guides often explore the depth of this connection, revealing how Jesus embodies the prophetic pain and ultimate redemption.

Lists documenting these quotations emphasize the intentionality of the Gospel writers in portraying Jesus as the fulfillment of ancient scripture.

Psalm 110:1 & Hebrews 1:13 (Sit at My Right Hand)

Psalm 110:1, declaring “The Lord said to my Lord, ‘Sit at my right hand,’” finds striking resonance in Hebrews 1:13, where it’s applied to the ascended Christ. A comprehensive PDF detailing Old Testament quotations in the New Testament underscores this pivotal connection.

This quote, frequently included in PDF study resources, establishes Jesus’ divine status and authority. The “right hand” symbolizes power and honor, signifying Jesus’ exaltation after his sacrifice. Lists of these quotations demonstrate how New Testament authors consistently drew upon the Old Testament to validate Jesus’ identity.

Exploring these intertextual links within a PDF compilation reveals a deliberate theological argument for Jesus’ supremacy.

Quotation of Isaiah

Isaiah’s prophecies are extensively quoted within the New Testament, forming a cornerstone of Messianic fulfillment. A detailed PDF list of Old Testament citations reveals the frequency with which New Testament authors reference Isaiah. These quotations aren’t merely historical echoes; they are presented as deliberate confirmations of Jesus’ identity and mission.

Resources, often available as PDF study guides, highlight key passages like Isaiah 7:14 (Virgin Birth) and Isaiah 53 (Suffering Servant). Examining these connections within a PDF compilation demonstrates how the New Testament authors interpreted Old Testament prophecies through the lens of Jesus Christ.

Such PDF resources are invaluable for understanding the theological continuity between the Testaments.

Isaiah 7:14 & Matthew 1:23 (Virgin Birth)

Isaiah 7:14, proclaiming a virgin will conceive and bear a son named Immanuel, finds striking fulfillment in Matthew 1:23, detailing the miraculous birth of Jesus Christ. A comprehensive PDF list of Old Testament quotations in the New Testament meticulously documents this pivotal connection.

PDF study guides often emphasize how Matthew directly quotes Isaiah using the Septuagint translation, highlighting the divine nature of Jesus’ conception. This quotation isn’t simply a historical reference; it’s a theological assertion of Jesus’ unique origin.

Exploring this connection within a PDF compilation reveals the intentionality of the New Testament authors in presenting Jesus as the promised Messiah, fulfilling ancient prophecies.

Isaiah 9:2 & Matthew 4:16 (Light Shining in Darkness)

Isaiah 9:2 vividly depicts a people walking in darkness who will see a great light, a prophecy powerfully echoed in Matthew 4:16, describing Galilee as a land enveloped in darkness, now illuminated by Jesus’ presence. A detailed PDF compilation of Old Testament quotations in the New Testament showcases this significant parallel.

PDF resources often highlight how Matthew utilizes this Old Testament passage to establish Jesus as the fulfillment of prophetic hope, bringing spiritual enlightenment to a world lost in sin.

Examining this connection within a PDF study guide reveals the intentional use of imagery, portraying Jesus as the divine light overcoming spiritual darkness, a central theme in Matthew’s Gospel.

Isaiah 53:5 & 1 Peter 2:24 (Suffering Servant)

Isaiah 53:5 poignantly describes the suffering servant, wounded for our transgressions and bruised for our iniquities, a prophetic image strikingly fulfilled in Jesus Christ. 1 Peter 2:24 directly references this passage, declaring that Jesus “himself bore our sins in his body on the tree,” connecting his suffering to the Old Testament prophecy.

A comprehensive PDF list of Old Testament quotations reveals the New Testament authors’ deliberate linking of Jesus to the suffering servant archetype.

PDF study guides often emphasize how this connection demonstrates Jesus’ sacrificial death as a purposeful act of redemption, fulfilling God’s plan as foretold in Isaiah. This intertextual link is crucial for understanding Christian theology.

Types of Old Testament Quotations

PDF compilations categorize quotations as direct, indirect (allusions), or paraphrases, revealing how New Testament authors engaged with Old Testament texts.

Direct Quotations

Direct quotations represent verbatim copies of Old Testament passages within the New Testament text. These are easily identifiable as the New Testament author explicitly cites the original wording. A PDF compilation focusing on Old Testament quotes in the New Testament will meticulously list these instances, often including cross-references to the original Hebrew or Aramaic text, and the Septuagint (Greek translation).

Examples abound, such as the frequent citations of Psalm 22 by Jesus on the cross (Matthew 27:46), or the use of Isaiah 7:14 in Matthew 1:23 concerning the virgin birth. These direct quotes demonstrate the New Testament authors’ intention to present Jesus as the fulfillment of specific Old Testament prophecies, bolstering their claims about His identity and mission. Resources like those found on Pinterest often highlight these direct connections.

Indirect Quotations (Allusions)

Indirect quotations, or allusions, are more subtle than direct quotes. They involve referencing Old Testament themes, stories, or phrasing without explicitly stating the source. A comprehensive PDF list of Old Testament quotes in the New Testament must identify these allusions, requiring careful literary analysis. Recognizing these connections enriches understanding of the New Testament’s depth.

For instance, the New Testament’s depiction of Jesus as the “Lamb of God” alludes to the sacrificial system in the Old Testament, particularly the Passover lamb. Pinterest resources often point out these less obvious connections. Identifying allusions requires familiarity with both Testaments. These allusions demonstrate the New Testament authors assumed their audience possessed knowledge of the Old Testament, building upon that foundation to reveal Jesus’ significance.

Paraphrases

Paraphrases represent another layer of Old Testament influence in the New Testament. Unlike direct quotations, paraphrases reword Old Testament passages, conveying the same meaning in new language. A detailed PDF compilation of Old Testament quotes must include these, as they demonstrate a nuanced understanding of the Hebrew scriptures. Identifying paraphrases requires recognizing thematic echoes and conceptual similarities.

For example, the concept of a “new covenant” in Jeremiah is echoed, though not directly quoted, in the New Testament writings about Jesus’ sacrifice. Pinterest resources highlight how New Testament authors creatively adapted Old Testament ideas. These paraphrases weren’t considered less authoritative; they demonstrated the ongoing relevance of the Old Testament message within a new context, revealing its fulfillment in Christ.

Theological Implications

Examining Old Testament quotations within a PDF reveals Jesus as the Messiah, fulfilling prophecy and demonstrating the continuity of God’s plan throughout scripture.

Fulfillment of Prophecy

A detailed PDF compilation of Old Testament quotes in the New Testament powerfully illustrates the concept of prophetic fulfillment. The New Testament authors consistently presented Jesus as the one foretold in Hebrew scripture, demonstrating that historical events weren’t random, but divinely orchestrated.

For instance, passages like Isaiah 7:14, predicting a virgin birth, find direct fulfillment in Matthew 1:23. Similarly, Psalm 22’s depiction of suffering—particularly the piercing of hands and feet—resonates with the crucifixion narrative in Matthew 27.

These aren’t merely coincidences; they are deliberate connections made to establish Jesus’s messianic identity. Studying these quotations, often conveniently organized in PDF format, reveals a cohesive narrative of God’s redemptive plan unfolding throughout history, culminating in Christ.

Continuity Between Testaments

A comprehensive PDF listing Old Testament quotations within the New Testament underscores the remarkable continuity between the two sections of the Bible. It demonstrates that the New Testament doesn’t discard the Old, but rather builds upon its foundation, revealing its deeper meaning.

The consistent referencing of Old Testament law, poetry, and prophecy highlights a unified storyline of God’s relationship with humanity. Examining these connections, often readily available in compiled PDF guides, reveals that the New Testament isn’t a separate religion, but the fulfillment of promises made long ago.

This continuity is crucial for understanding the theological coherence of scripture, showing God’s unwavering faithfulness and consistent character throughout history. Resources like those found on Pinterest emphasize this interconnectedness.

Understanding Jesus as the Messiah

A detailed PDF compilation of Old Testament quotations in the New Testament powerfully demonstrates how Jesus fulfills Messianic prophecies. These verses, meticulously listed, reveal Jesus as the promised King, suffering Servant, and ultimate Savior foretold by the prophets.

The New Testament authors frequently pointed to Old Testament passages to establish Jesus’ identity and validate His claims. Examining these connections, often presented in accessible PDF formats, clarifies how Jesus embodies the hopes and expectations of Israel.

Resources, like those highlighted on platforms such as Pinterest, showcase how specific Old Testament verses directly relate to Jesus’ life, death, and resurrection, solidifying His role as the long-awaited Messiah.

Resources for Studying Quotations

Numerous online databases, commentaries, and readily available PDF study guides catalog Old Testament quotes within the New Testament, aiding deeper scriptural analysis.

Online Databases

Several robust online databases are invaluable for tracing Old Testament quotations within the New Testament. These platforms often provide searchable lists, categorized by Old Testament book and verse, alongside corresponding New Testament references. Bible Gateway and Blue Letter Bible are excellent starting points, offering various translations and interlinear options to examine the original languages.

Furthermore, dedicated websites and PDF compilations, frequently shared on platforms like Pinterest, curate extensive lists of these intertextual connections. These resources often include detailed analyses of the context, original Hebrew meaning, and theological implications of each quotation. Searching for “Old Testament quotes in New Testament PDF” yields numerous downloadable study guides and charts, facilitating in-depth research and understanding of this crucial aspect of biblical scholarship.

Commentaries

Scholarly commentaries provide in-depth analysis of Old Testament quotations found within the New Testament, offering crucial context and interpretation. Matthew Henry’s Complete Commentary and the IVP New Testament Commentary Series are highly regarded resources, often detailing the original Hebrew source and its significance. These commentaries frequently discuss how New Testament authors understood and applied Old Testament passages.

Additionally, many commentaries are available online or as downloadable PDFs, supplementing traditional print editions. Resources discovered through searches on platforms like Pinterest often point to specific commentary excerpts focusing on intertextuality. Examining multiple commentaries allows for a nuanced understanding of each quotation, considering various theological perspectives and historical backgrounds, enriching the study of these vital connections.

PDF Compilations & Study Guides

Numerous PDF compilations and study guides specifically catalog Old Testament quotations within the New Testament, offering a convenient resource for researchers and students. These documents often present the Old Testament verse, the New Testament citation, and a brief explanation of the connection. Pinterest frequently links to downloadable lists and charts organizing these intertextual references.

Many Bible study websites and theological institutions provide free PDF study guides focusing on this topic, aiding in deeper scriptural analysis. These resources streamline the process of identifying and understanding the rich tapestry of Old Testament fulfillment in the New Testament, offering a focused approach to exploring these vital connections.

The Richness of Intertextual Connections

Ultimately, examining Old Testament quotations in the New Testament—facilitated by resources like PDF lists—reveals a deliberate and profound connection between the two testaments. This intertextuality isn’t accidental; it demonstrates the New Testament authors’ understanding of, and reliance upon, the Hebrew Scriptures.

Resources found online, including those shared on platforms like Pinterest, highlight how the New Testament fulfills Old Testament prophecies and themes. Studying these connections deepens our understanding of Jesus as the Messiah and the continuity of God’s redemptive plan. A PDF compilation serves as a valuable tool for tracing these threads, enriching our appreciation for the unified narrative of the Bible.